NEWS & INSIGHTS

News - September, 2024

Software is eating Private Equity – and creating insatiable demand for private software companies

10 years ago, we sold our first software company to a private equity fund. It was new - and very successful - for both of us. Since then, software has become the largest sector for private equity. And private equity has become the most important acquirer of private software companies.

Private Equity’s push into software investing

The private equity investment model relies on acquiring companies with stable and growing cash flows. The ideal target company is a mature, profitable business with strong moats around it and can expect to remain profitable for a long time. As part of the transaction, the target companies are leveraged significantly to translate the typically slow profitability growth of the acquired companies into the much higher equity returns that private equity needs to convince investors to go into the asset class.

Traditionally, private equity’s preferred hunting grounds were financial services, energy, healthcare, and manufacturing. These are mature, stable and profitable industries, not overly cyclical, but not high growth.

Technology was traditionally shunned by private equity because companies tended to invest their free cash in high growth, rather than producing large profits. Moreover, technological innovation would periodically and in unpredictable ways disrupt previous champions. The moats weren’t reliable enough.

The SaaS business model with its multi-year subscription model changed this: recurring revenues are more stable. At scale, these businesses have strong, growing cash-flows, that are very bankable. At first, only specialist US-funds discovered the opportunity. Notably Thoma Bravo, Vista Equity and Francisco Partners made a name for themselves. Soon thereafter, European players such as Hg and Main Capital copied the model.

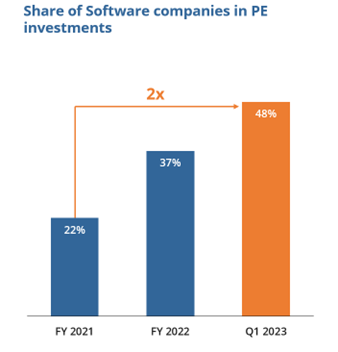

Eventually, generalist private equity firms started to invest in software, too. Today, most generalist private equity firms have a technology team and software amounts to almost half of all European private equity investments:

Source: Clipperton Finance

Private Equity has become the biggest buyer of software companies

Industry leaders have pioneered a software investing model that’s not only focused on the financial engineering and operational improvement of the portfolio companies acquired, but also includes a very active M&A strategy. As a result, these private equity firms not only buy a few medium and large software companies but also – indirectly – many smaller ones as part of a buy and build strategy.

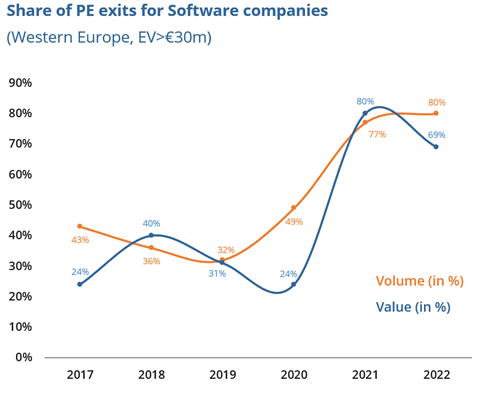

According to analysis by Clipperton Finance, 80% of all exits of European software companies in 2022 were sales to private equity firms.

Source: Clipperton Finance

A game changer for software investing

10 years ago, essentially all software exits were IPOs or trade sales to strategic buyers. Selling to strategic buyers can be notoriously difficult: Only a few logical buyers with a strong strategic technological fit exist. At the time of the planned exit, these buyers may well be distracted by management changes, operational challenges, poor trading or other issues and simply not be interested. As a result, it’s hard to orchestrate a competitive exit process and the outcome of a trade sale can disappoint.

Private equity buyers are different. Private equity firms are in the business of buying companies. They may be thorough in due diligence, they may be disciplined in pricing, but they don’t need a strategic technological fit. So, in principle, they would always be interested. As a result, it is a lot easier to get enough competitive buyers into the process and to receive fair value.

Private Equity’s interest in software is starting to create a powerful flywheel. More software investments lead to more add-on acquisitions resulting in larger businesses. These larger companies attract yet more private equity capital enabling yet more and larger add-on investments. A virtuous circle has been created. This reliable exit channel is a game-changer for software investors.

How growth funds can leverage the opportunity

During the years 2020-2022, characterized by high valuations and easy money for software companies, many businesses have been built to become unicorns. High growth was required, and high burn-rates and some inefficiencies could be tolerated. The goal was to go public or at least to be acquired by a major software firm for a strategic value.

In the current market environment, these two options are a lot less likely, even for good businesses. So, if indeed these two exit strategies failed, such companies have no immediate fallback option for exit. Numerous such situations exist. Private equity could be an acquirer but will look for a different financial profile. Therefore, companies first need to cut costs, slow down growth, become efficient and eventually reach profitability. This process is not done overnight and will likely require incremental funding.

If these businesses have strong technology, healthy unit economics and sufficient scale, then growth funds can apply a new “venture-to-private-equity” investment model. They can identify compelling companies that have embarked on this transformation, provide further funding and accompany the businesses in their transformation from “growth at all cost” to “efficient growth” and position them for a sale to private equity. If you get their KPIs to a shape and form that is compatible with private equity, then a successful sale is predictable, given the sustained demand by private equity explained above. “If you build it, they will come.”

Summary

Over the past ten years, software has become an important business for private equity. At the same time, private equity has become a reliable exit channel for European software companies.

This creates an opportunity for European growth funds to take formerly venture-backed software businesses, transform them in ways that are compelling to private equity buyers and take advantage of this profitable and predictable route to exit for the benefit of all parties involved.

by Roland Dennert, Managing Partner at Cipio Partners