NEWS & INSIGHTS

News - March, 2024

Cipio Partners Completes Sale of Silicon Mobility

Munich/Luxembourg – March 4, 2024 – Cipio Partners has completed the sale of its portfolio company, Silicon Mobility SAS, to Intel Corp.

Founded in 2015 and headquartered in Sophia Antipolis, France, Silicon Mobility is a fabless semiconductor company that develops innovative semiconductor solutions for electric vehicles.

Cipio Managing Partner, Roland Dennert, commented: “The transaction is a win for France’s deep tech technology ecosystem. Cipio Partners is proud to be one of the leading foreign growth investors in the French market.”

The Sellers were advised by Ancoris Capital Partners, New York, and Jones Day.

About Silicon Mobility

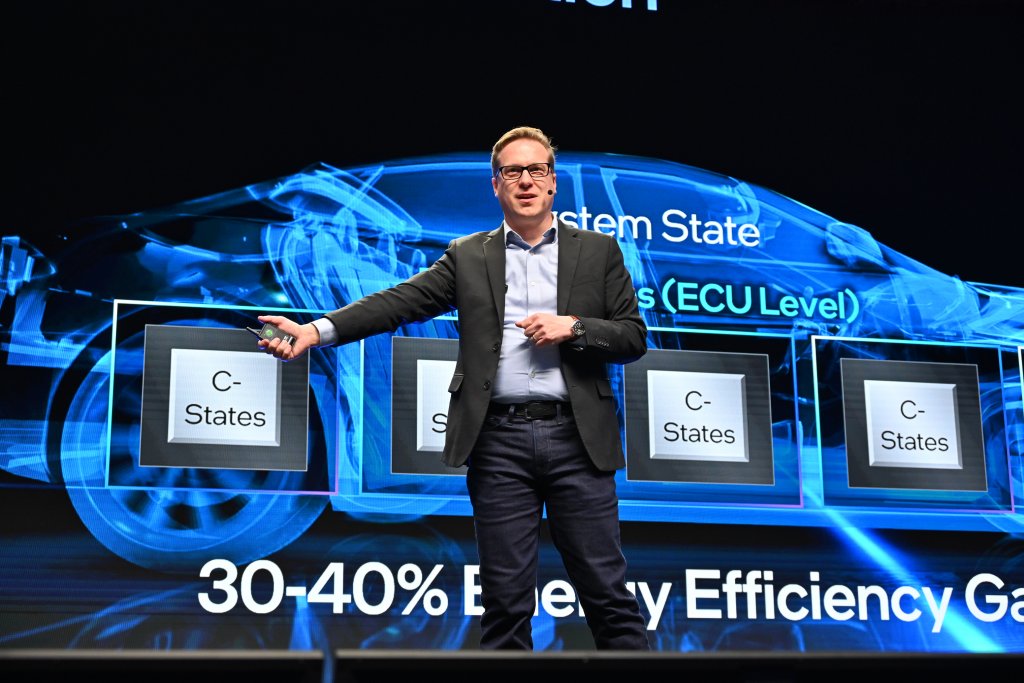

Silicon Mobility is a full-stack technology player powering control solutions for cleaner, safer and smarter mobility. The company designs, develops, and sells flexible, real-time, safe, and open semiconductor solutions for the automotive industry used to increase energy efficiency and reduce pollutant emissions while keeping passengers safe. Silicon Mobility’s products control electric motors, battery and energy management systems of hybrid and electric vehicles. By using Silicon Mobility’s technologies, manufacturers improve the efficiency, reduce the size, weight, and cost of electric motors, and increase the battery range and durability. Silicon Mobility technologies and products accelerate the car’s powertrain electrification and the deployment of driverless vehicles for OEMs. To find out more, visit www.silicon-mobility.com

About Cipio Partners

Founded in 2003, Cipio Partners is a leading investment management and advisory firm for European growth capital & minority buyouts for technology companies. Cipio Partners targets European growth stage technology businesses with €10-50 million in revenue and makes initial investments ranging from €5-15 million. Cipio Partners operates from offices in Munich and Luxembourg. Further information is available at www.cipiopartners.com

About Ancoris Capital Partners

Ancoris Capital Partners is a New York headquartered specialty investment bank, purpose-built for the private capital markets. The firm specializes in structured capital raises, growth financings and strategic advisory for its global clients. Further information is available at www.ancorispartners.com

Media contact

Sophie von Eberhardt: X4ypxbWVkaWFAY2lwaW9wYXJ0bmVycy5jb20=