NEWS & INSIGHTS

News - June, 2023

Cipio Partners was founded twenty years ago. Time to reflect on twenty years of European Technology Investing.

European technology investment only appeared on the map in the late 90s. When the internet bubble burst, it destroyed the fledging European technology and venture capital industry, which took well over a decade to recover.

Twenty years ago, European technology was in an existential crisis

In the late 1990s, the emergence of the internet triggered the creation of the very first generation of European technology start-ups. Young – and not so young - entrepreneurs left corporate jobs and consulting firms to start their internet company. The New Economy was born. Soon the first generation of venture capital firms followed. European venture capital investments came from nowhere to peak at €22 billion (1) in 2000.

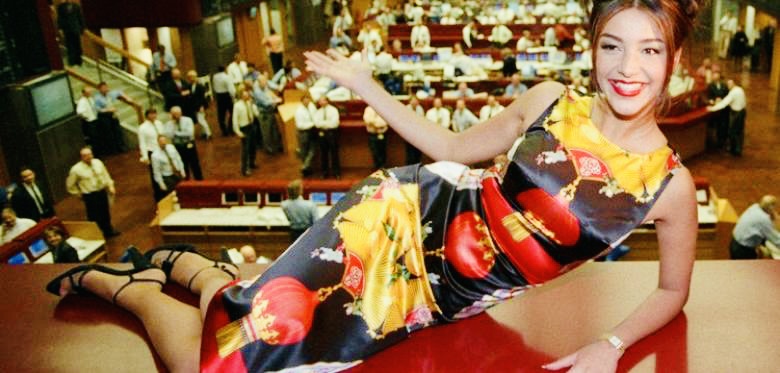

The so-called Neuer Markt, created in 1997 to mirror the American NASDAQ, constituted a path to liquidity for this first cohort of European venture-backed companies. It triggered a gold rush. Taxi drivers and dentists asked for your opinion on the latest IPO. However, on March 10, 2000 the Neuer Markt peaked and subsequently declined by 96% in 31 months. €200 billion were lost (2). Neuer Markt closed down to never return.

Funding dried up and numerous listed and unlisted technology companies went bankrupt. Most European venture capital funds and corporate VC programs closed. Limited Partners turned their back on European venture capital and government funding for technology disappeared. The entrepreneurs and venture capitalists of the internet ruefully returned to corporate jobs in the old economy. Many had seriously damaged their careers. The description of this period as “nuclear winter” was not an exaggeration.

The markets were saying that technology investing was a waste of time and money. It was entirely unclear if the European technology industry could create value. The holders of the few surviving technology companies wanted to get out, almost at any cost. This was the environment when Cipio Partners started out. We believed in the future of technology investing even in its darkest days. The initial opportunity we seized was to acquire orphaned technology portfolios. In 2004 we were able to acquire portfolios from Deutsche Telekom and Daimler-Chrysler. In 2005, we added portfolios from Infineon and West LB. In 2007, we acquired Siemens Venture Capital.

The lost decade of European Venture Capital

After the year 2000, very little happened in European Venture Capital for almost a decade. Few and only small venture capital funds were raised. Few technology companies were started or funded. It is interesting to compare the level of US and European venture capital investments. In 2000, European venture capital investments had grown from nothing to a respectable 24% of the US investments. By 2006 the ratio had declined again to 10%. European venture capital was essentially extinct.

Interestingly, the financial crisis starting in 2007 was not damaging to venture capital; it might even have been beneficial. Central banks in the western world flooded the market with liquidity, reduced interest rates and started quantitative easing. The world entered an extreme low-interest rate phase that made it difficult for investors to earn a good return. Curiously, this made venture capital more attractive. In spite of past disappointments, money slowly started to come back.

In 2007, the Samwer brothers established Rocket Internet, the Berlin-based internet incubator. Mostly, the company copied proven business models from the US and brought them to Europe and emerging markets. The Samwers’ fundraising genius allowed them to build large businesses without relying on funding from – virtually inexistent – venture funds. Their standout success was Zalando, that went public in 2014. Other successful e-commerce firms followed.

Rocket Internet became the training ground for a second generation of German internet entrepreneurs. Atomico has estimated that 400 German founders cut their teeth there (3).

A second generation of VC firms such as Project A, Cherry Ventures, HV Capital started in the same period and could show some early success in e-commerce.

By 2017 the dynamism of the late 90s had returned. It had taken well over a decade for European technology to recover from the bursting of the internet bubble. Finally, after 17 years, European venture capital amounted once again to more than 24% of the US, the same level as in 2000.

US technology industry bounced back bigger and better

The development in the US could not have been more different.

The US technology industry was created in the late 1950s by the early semiconductor companies such as Fairchild. In the 1970s it saw its first boom when companies such Microsoft, Apple and Intel were created and eventually went public. Silicon Valley had established a proven model of creating industries and financial value: Technology, the informal culture of California, Stanford University, venture capital and NASDAQ. The emergence of the internet in the late 1990s triggered just another cycle.

The NASDAQ Composite Index peaked on March 10, 2000 and subsequently declined by 78% in 31 months. As in Europe, numerous listed and unlisted technology companies went bankrupt. But while a lot of money was lost in 2000-2002, there was never any doubt that technology startups build new industries and tremendous financial value.

Limited partners stayed put. Venture Capital firms survived. Only two years after the bursting of the internet bubble US venture capital started to grow again.

In 2004, Google and Salesforce went public, and Facebook was founded. These events established search and online advertising, the software-as-a-service business model, and social media as major forces in the industry.

Conclusion

Rome was not built in a day. Building a technology ecosystem takes time. The US venture capital industry was established in the 1950s and went through many cycles since. When the internet bubble burst in 2000, the industry was proven and resilient. Nobody panicked. Nobody lost faith. Nobody went back into the old economy. Very quickly the industry recovered and moved from internet infrastructure to new areas of excitement, such as cloud computing and social media.

In Europe, when the internet bubble burst, the technology ecosystem was immature. No one knew if European technology “worked”. And indeed, many companies were fundamentally unsound. Many, if not most investors had made mistakes. It was not hard to write the industry off and that’s what most people did. It took a few remaining believers well over 10 years to prove their raison d’être. Cipio Partners was among them.

Sources:

Image by Katja Lenz: Verona Feldbusch (today Pooth) at Telegate’s IPO in April 1999 (Picture-Alliance)

(1) VentureOne: State of the market: Venture Capital in the US, Israel and Europe

(2) https://de.wikipedia.org/wiki/Neuer_Markt

(3) https://www.n-tv.de/wirtschaft/Rocket-Internet-ist-die-erfolgreichste-Startup-Mafia-article22991471.html